When it comes to insuring your business, commercial property insurance is one of the most important types of coverage you can have. This type of insurance protects your business property from damage or loss, which can include everything from the building your business is housed into the contents inside.

Commercial property insurance can be a complex topic, so we’ve put together a simple guide to help you understand what you need to know.

What Does Commercial Property Insurance Cover?

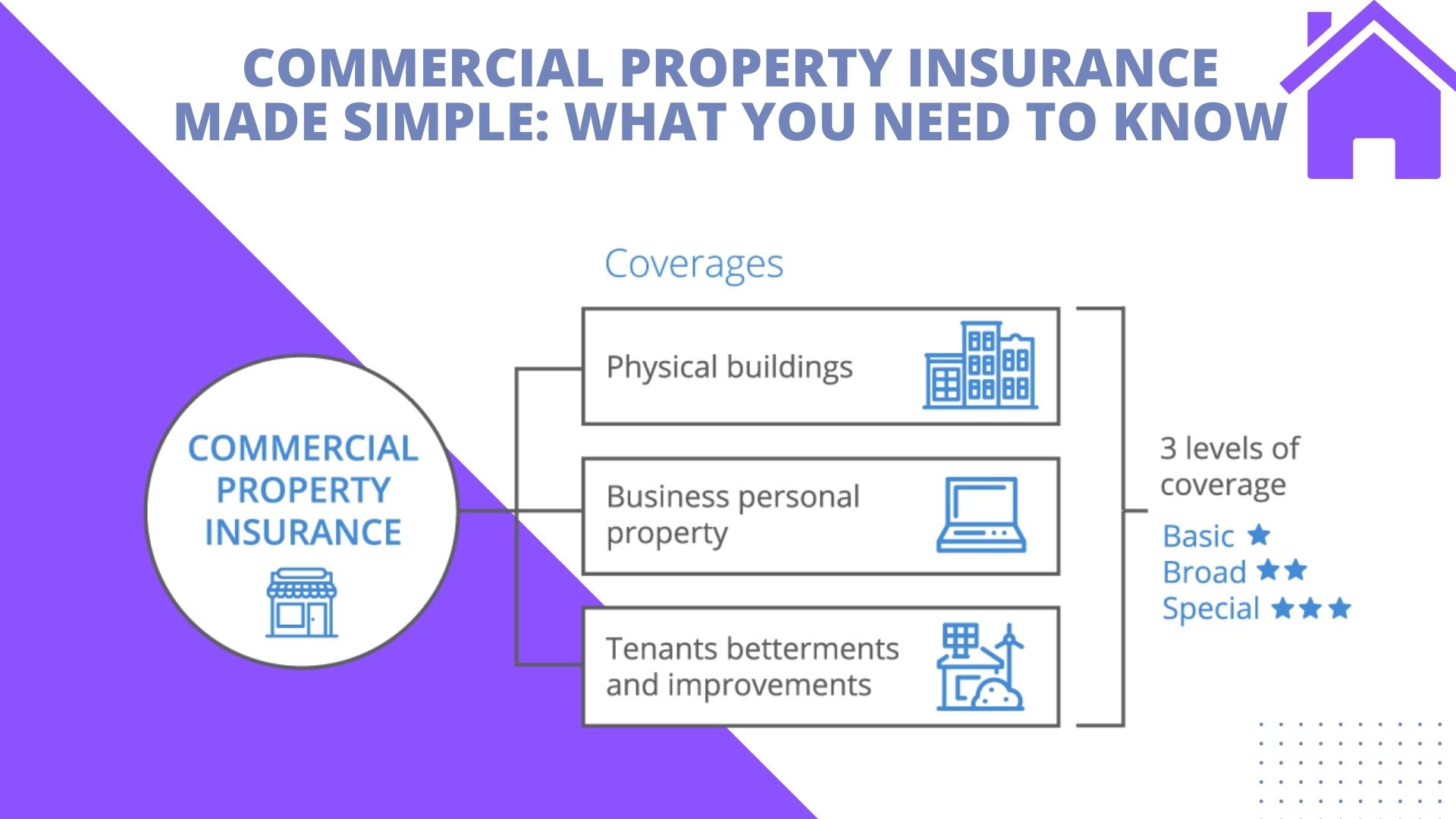

Commercial property insurance can provide coverage for a variety of things, including:

The physical structure of your business – This can include the building itself, as well as any attached structures like decks or patios.

Your business contents – This can include things like furniture, equipment, inventory, and even money and valuable documents.

Loss of income – If your business is forced to close due to covered property damage, this type of coverage can help replace the income you lose during that time.

What Does Commercial Property Insurance Not Cover?

There are also some things that commercial property insurance doesn’t cover, including:

Flood damage – This is a separate type of coverage that you’ll need to purchase if you want protection from floodwaters.

Earthquake damage – Similar to floods, earthquakes require their own separate policy.

Intentional damage – If you or someone working for you damages your property intentionally, it won’t be covered.

How Much Does Commercial Property Insurance Cost?

The cost of commercial property insurance will vary depending on a number of factors, including the value of your property and the level of coverage you need. You may also be able to get a discount if you have other types of insurance with the same company, such as business liability insurance.

Recommended Additional Commercial Property Coverage

In addition to commercial insurance coverage, there are a few other types of coverage you may want to consider for your business, including:

Business property insurance – This type of coverage can protect your business property from damage or loss due to things like fires, theft, or vandalism.

Equipment Breakdown– This coverage can protect you from the costs of repairing or replacing equipment that breaks down due to normal wear and tear.

Business Interruption Insurance- Business interruption insurance can help you replace lost income if your business is forced to close due to a covered event, like a fire.

Workers Compensation- If you have employees, this type of coverage can help pay for their medical expenses and lost wages if they’re injured on the job.

Now that you know a little more about commercial property insurance, you can start shopping for the right policy for your business. Be sure to compare quotes from multiple insurers to find the best rate.

How do I value my property for commercial property insurance?

There are a few different ways to value your property for commercial property insurance purposes. The most common method is to ensure your property for its replacement cost, which is the amount it would cost to rebuild or replace your property in the event of a covered loss.

You can also choose to insure your property for its actual cash value, which takes into account depreciation.

Do I Need Commercial Property Insurance for My Business?

If you fail to purchase property insurance, then you are responsible for paying off any damages on your own.

In the event of a worst-case scenario like a fire that burns down all your equipment and inventory- without insurance as an option, it’s possible that this could put you out of business.

Click Below To Know More About Insurance Service Provider

- Things to Know Before Buying Insurance for Home in 2022

- Tips and Benefits of Buying Car Insurance

- All You Need to Know About Different Types of Personal Insurance Coverage

- Why You Should Buy Home Insurance?

- Top 10 Benefits of Car Insurance

- What is SR- 22 Insurance and What Does it Do?

- Importance of Individual Life Insurance Policies

- Things to Know Before Buying Insurance for Home in 2022

- Commercial Property Insurance Made Simple: What You Need to Know