What is Umbrella Insurance?

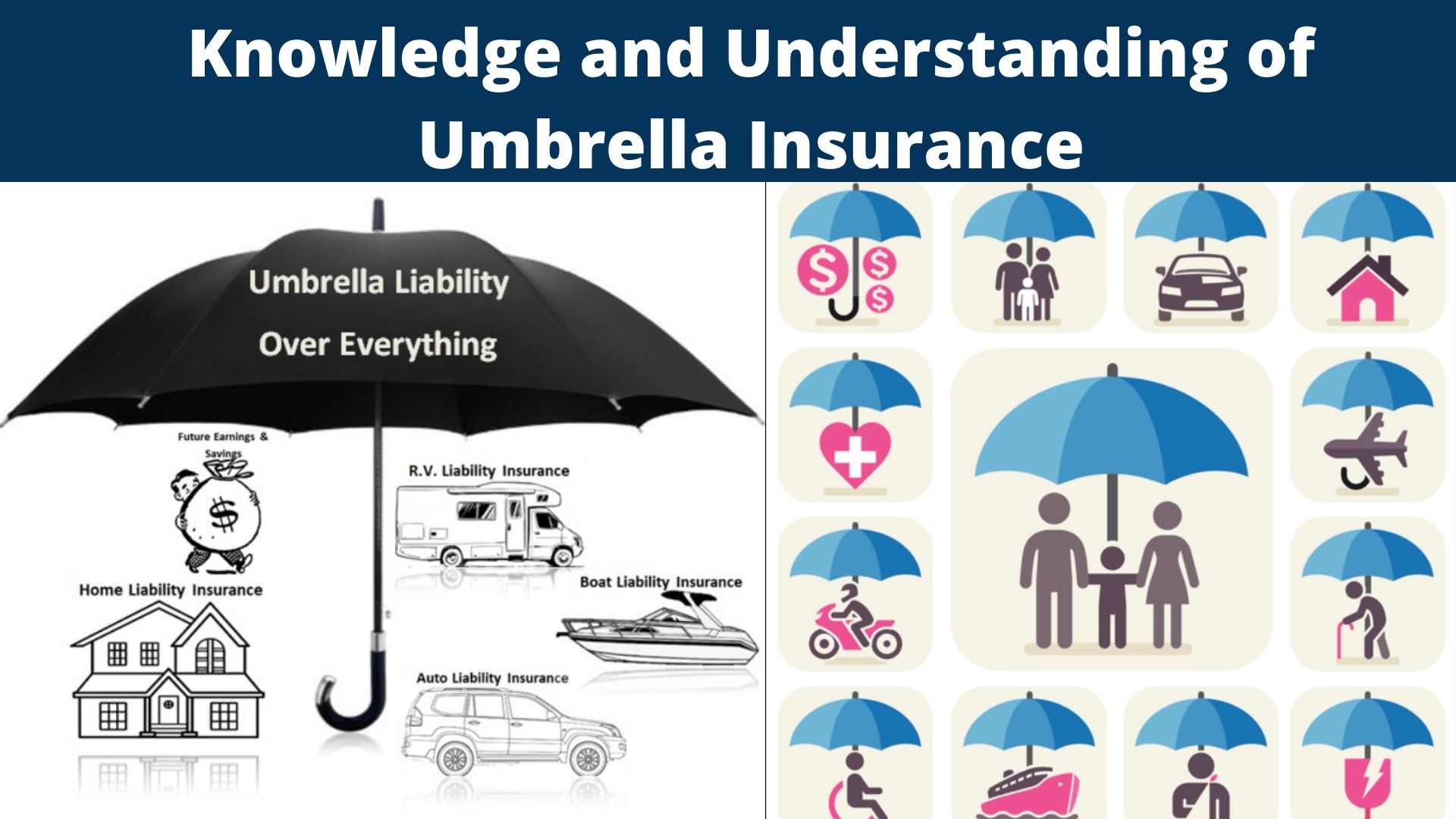

Umbrella insurance is an extra protection for your liability and it protects you from excess liability that may be forced on you. In simpler words, it’s an excess liability coverage or excess liability policy. Using an excess liability policy protects you from excess liability. It is especially useful when your previous insurance like auto insurance or house insurance exhaust. Apart from it, this also provides you cover when your other liability coverage is not enough for the damage done by you.

How much umbrella insurance do I need?

You should have at least enough umbrella insurance so that you can cover your net worth. To find out how much umbrella insurance coverage you need, you can add up the total value of your assets including the value of your home, auto, savings and investment accounts. Then, analyze the previous liability insurance that you have through your already existing policies. Once done, find the difference between your net worth and your insurance money, then buy umbrella insurance enough to make up the difference.

What does umbrella insurance cover?

Umbrella insurance provides coverage to you and your family members against lawsuits that involve bodily injury to other people, damage to other people’s property and other claims like defamation- slander and libel, and false imprisonment. In addition to that, your umbrella insurance will also cover all the legal costs associated with the lawsuit. For example, if your umbrella policy provides you with liability coverage worth $1 million, and somebody sued you for that full amount. In that case, your insurer would pay out the full liability amount and also provide for your legal cost associated with the lawsuit.

For example, if your dog suddenly gets angry and bite someone, and you find yourself in lots of financial trouble. And, that person sued you for health loss, mental loss, daily wages loss and for much more, and the court decides that you have to pay them half a million for their losses. But sadly, your house owner policy only covers the half of the penalty decided by the court. Moreover, you want to pay that settlement money, but you don’t want to pay it from your own pocket. In that case, your umbrella insurance policy takes care of that excess liability, which is left after your homeowner insurance.

Who needs umbrella insurance?

Well, we live in a world where unprecedented situations can come up at any point of time. With that said, everyone in this world is at risk of getting into trouble and then sued for one reason or the other. So, in case, your total value of assets including savings accounts, investment accounts and home equity is more than your auto or homeowner equity, then you should buy umbrella insurance. This will provide you with enough liability insurance so that you can cover your assets completely and don’t lose them in a lawsuit. In simpler words, umbrella policy protects you from any extra burden that can come onto you.

How much does umbrella insurance cost?

Umbrella insurance is not very expensive. As per reports, a $1 million policy can have installments between $150 and $300 per year. However, you should have minimum auto and home liability insurance to buy an umbrella coverage worth million dollars. You can only buy it if you have a comparatively larger amount of coverage on your auto and home insurance. Moreover, you should have a minimum liability coverage of $300,000 (or more) for homeowners and $250,000 per person for auto insurance.