In the heart of California, Riverside bustles with a unique blend of dreams, aspirations, and entrepreneurial spirit. From the sunlit facades of commercial buildings to the welcoming archways of apartment complexes, every brick and beam tells a story of ambition. But as every savvy business owner knows, with ambition comes responsibility. And in the world of business, that responsibility often translates to two words: business insurance. It’s not just about safeguarding assets; it’s about ensuring that the Riverside dream thrives, come rain or shine.

The Business Insurance Landscape in Riverside

Riverside isn’t just a city; it’s a vibrant tapestry of business stories. Each entrepreneur, from the cafe owner to the commercial property mogul, adds a unique thread to this intricate mosaic. But behind every success story, there’s an unsung hero: business insurance. This protective shield ensures that while entrepreneurs aim for the stars, they’re grounded in security.

In the heart of Riverside, businesses of all sizes and sectors thrive. The local cafe owner, brewing the perfect cup of coffee, the tech startup innovating in a downtown loft, and the family-run store that’s been a community staple for decades—all are integral parts of Riverside’s business fabric. And while their visions and goals might differ, they all share a common need: the assurance that their hard work and investments are protected.

Business insurance acts as this assurance. It’s not just about mitigating risks; it’s about fostering growth. In a city as dynamic as Riverside, where opportunities are as vast as the California sky, business insurance ensures that entrepreneurs can seize these opportunities without hesitation. From unforeseen accidents to unexpected challenges, business insurance stands as Riverside’s steadfast partner, ensuring continuity and confidence.

Moreover, Riverside’s business community is known for its camaraderie and collaborative spirit. Networking events, business fairs, and community-driven initiatives are common sights. In such a close-knit environment, the ripple effects of one business facing challenges can be felt across the community. Business insurance, in this context, isn’t just an individual safety net; it’s a community shield, ensuring that the collective Riverside dream remains vibrant and unshaken.

Any business owner in Riverside stands to gain from obtaining business insurance.

Commercial Building Business Insurance

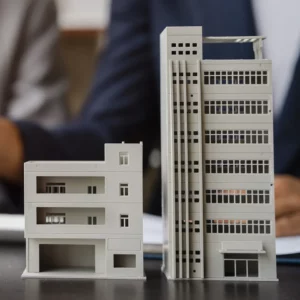

In Riverside, commercial buildings are more than just architectural marvels; they’re symbols of the city’s economic vitality and entrepreneurial spirit. These structures, from modern office complexes to historic storefronts, are the lifeblood of the community, housing dreams, ambitions, and countless success stories. But these edifices, while standing tall, are not immune to unpredictability.

Every commercial property in in Riverside has its own narrative. Some have witnessed the city’s growth over decades, while others are newer additions to the skyline. Yet, regardless of their age or design, they all share a common vulnerability to external threats. Natural disasters, structural damages, or even legal liabilities can pose significant challenges to building owners.

That’s where commercial property insurance comes into play. It’s not merely a document; it’s a declaration of commitment to safeguarding Riverside’s architectural legacy. This insurance covers a broad spectrum, from property damage and business interruption to liability protection. It ensures that even if calamity strikes, the recovery process is smooth, and businesses can bounce back with minimal disruption.

For many building owners in Riverside, their properties represent significant investments, both financially and emotionally. These buildings often house businesses that have been nurtured over years, if not generations. The thought of any harm coming to them can be daunting. Commercial building business insurance offers peace of mind in this regard. It’s a testament to Riverside’s forward-thinking ethos, ensuring that its iconic structures remain not just as landmarks but as thriving hubs of commerce and innovation.

Vacant buildings require business insurance to protect it from crime and vandalism.

Vacant Space Insurance

Riverside, with its rich history and dynamic future, is a city of contrasts. Among its bustling streets and thriving businesses, there are spaces that stand still, waiting for their moment. These vacant properties, whether they’re untouched plots or historical buildings awaiting renovation, hold a promise—a blank canvas ready to be transformed.

But while these spaces might seem dormant, they’re far from risk-free. Vacant properties can become targets for vandalism, theft, or even unintentional damages from natural elements. A sudden storm could cause structural damage, or an unnoticed leak could lead to significant water damage over time. These are spaces in transition, and their unique status brings with it a unique set of challenges.

Business insurance tailored for vacant spaces recognizes these challenges. It’s not just about covering potential damages; it’s about recognizing the potential of these spaces and ensuring they’re protected until they’re ready to shine. This specialized insurance takes into account the specific vulnerabilities of vacant properties, offering coverage that’s both comprehensive and customized.

For Riverside’s visionary developers and property owners, these vacant spaces represent opportunities. They’re the future sites of bustling businesses, vibrant community centers, or innovative residential spaces. Ensuring they’re protected during their dormant phase is crucial. After all, every great Riverside story starts with a vision, and business insurance for vacant spaces ensures that this vision remains unclouded by unforeseen challenges.

Owning an apartment building is a business. Thus, you need apartment building insurance.

Apartment Building Insurance

In the vibrant tapestry of Riverside’s business landscape, apartment buildings hold a special place. They’re not just structures; they’re communities, ecosystems of life and activity. From the laughter of children playing in courtyards to the daily interactions of neighbors, these buildings are pulsating hubs of human connection. But beyond the community they foster, they also represent significant business ventures for property owners.

Owning an apartment building in Riverside is a journey filled with both rewards and responsibilities. On one hand, there’s the satisfaction of providing homes, of shaping communities. On the other, there’s the intricate web of challenges that come with property management. Maintenance issues, tenant disputes, and even external threats like fires or natural disasters can pose significant challenges.

This is where apartment building business insurance steps in, acting as a steadfast ally for property owners. Tailored specifically for the multifaceted nature of apartment ownership, this insurance offers a holistic shield. It covers potential property damages, offers liability protection against tenant-related claims, and even provides coverage for lost rental income in certain scenarios.

For many Riverside property owners, their apartment buildings are more than just assets; they’re legacies. They represent years of hard work, investment, and vision. Ensuring they’re adequately protected is not just a business decision; it’s a commitment to the communities they house and the city they call home. With the right business insurance, Riverside’s apartment building owners can navigate the complexities of property management with confidence, knowing they’re prepared for both sunny days and stormy nights.

Protect Your Business with JMW Insurance Solutions

Riverside, with its sun-kissed streets and vibrant business pulse, is a testament to the power of dreams and determination. Every entrepreneur, property owner, and visionary adds to the city’s rich tapestry, pushing boundaries and redefining success. But as with any journey, the path of business and property ownership in Riverside is filled with both opportunities and obstacles.

Business insurance, in its various forms, emerges as the unsung hero in this narrative. It’s not just a protective measure; it’s a strategic partner, ensuring that Riverside’s business heartbeat remains strong and uninterrupted. From the towering commercial buildings that shape the city’s skyline to the vacant spaces brimming with potential, every facet of Riverside’s business landscape benefits from the shield of insurance.

For apartment building owners, business insurance is a testament to their commitment to their communities. It recognizes the unique challenges they face and offers tailored solutions, ensuring that the business of providing homes remains both rewarding and secure.

As Riverside continues to grow, evolve, and redefine its future, one thing remains constant: the need for foresight and protection. Business insurance stands as a beacon in this journey, offering both a safety net and a springboard. It’s a reminder that while risks are a part of the journey, they don’t define the destination.

And as the city looks ahead, JMW Insurance Solutions remains steadfast in its commitment. With expertise, dedication, and a deep understanding of Riverside’s unique needs, we’re here to ensure that the city’s business dreams continue to soar, anchored in security and confidence.